ZVC Investment Performance (2025)

【Overview】

In 2025, Z Venture Capital (“ZVC”) invested approximately USD 46.6 million across 51 companies, representing a meaningful increase in investment scale compared to the previous year.

ZVC further expanded its global investment activities with a primary focus on Japan, South Korea, Singapore, and the United States. As the corporate venture capital arm of LY Corporation, ZVC continued to strengthen its role as a long-term partner to startups, supporting their growth both domestically and internationally while working closely with local startup ecosystems in each region.

By stage, Seed-stage investments accounted for the largest share by number, with 36 companies, representing 35.2% of the total investment amount. In addition to Seed-stage investments, ZVC remained active across a broad range of stages, including Early stage, and will continue to pursue its all-stage investment strategy, supporting startups consistently from Seed through Later stages.

In 2025, ZVC also launched ZVC Fund II, a JPY 30.0 billion (approximately USD 193.5 million) fund. Through this fund, ZVC began expanding investments beyond core areas such as AI-DX, Physical AI, Space-tech. As advanced technologies such as AI move into a phase of broader adoption across industries and society, ZVC is further strengthening its support for startups that will drive the next wave of innovation and growth.

Additionally, in 2025, ZVC opened a U.S. office in San Francisco. This new hub serves as a strategic gateway connecting startup ecosystems in Japan, South Korea, and Southeast Asia with the United States, enabling more hands-on support for startups pursuing global expansion.

Overall, 2025 marked a significant milestone for ZVC, as the firm expanded its investment scale, geographic reach, and focus areas, and entered the next phase of growth together with its portfolio companies.

*All figures in this article are calculated at an exchange rate of 1 USD = 155 JPY

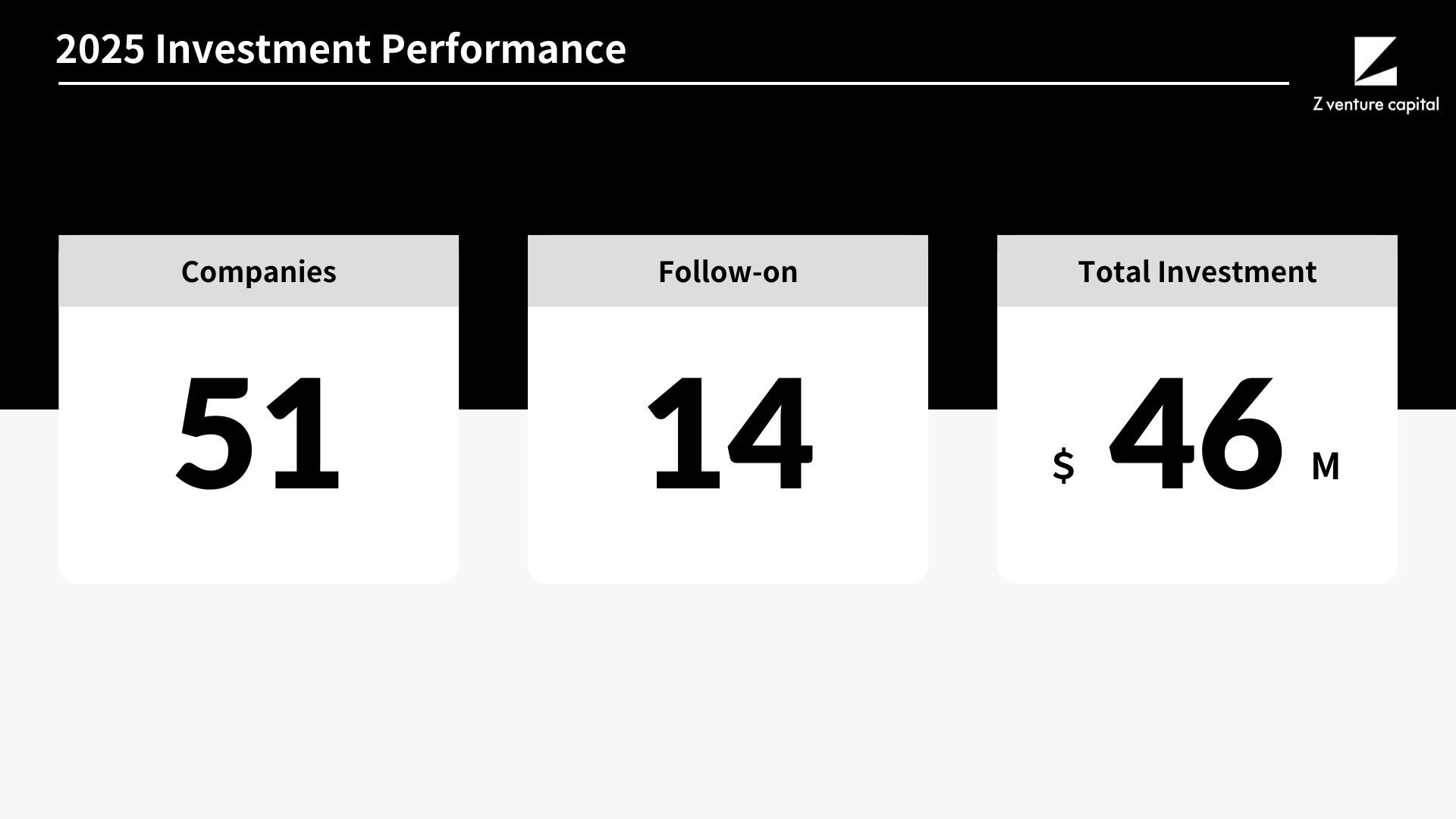

【2025 by the Numbers】

In 2025, ZVC invested approximately USD 46.6 million across 51 portfolio companies. Compared with 2024—when ZVC invested approximately USD 33.7 million across 54 companies—2025 marked a year of significant growth in total capital deployed, despite a slightly smaller number of investments. Of the 51 investments made in 2025, 14 were follow-on investments, reflecting continued support for high-performing portfolio companies.

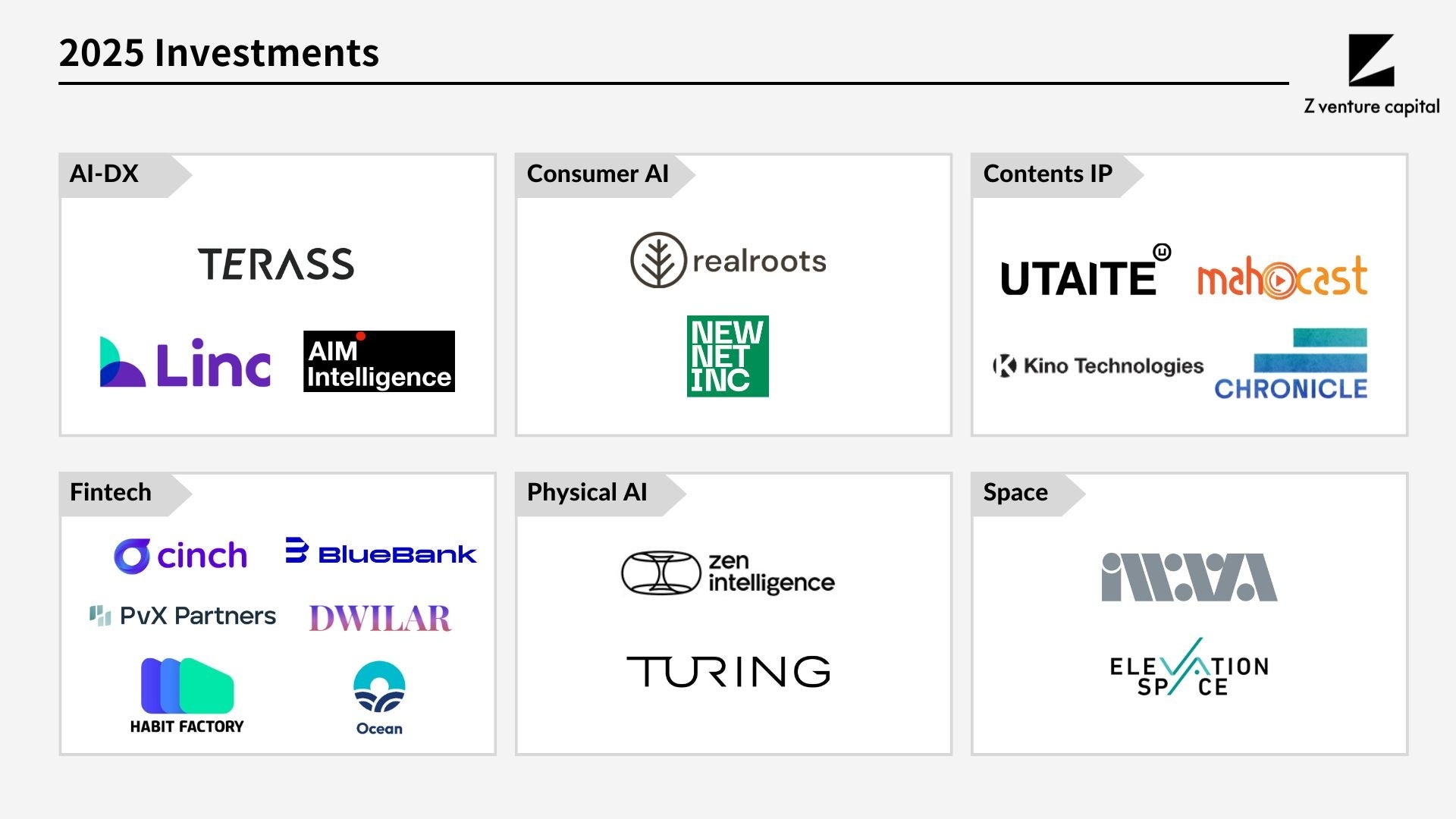

【Portfolio Companies】

In 2025, ZVC invested in startups with strong and defensible competitive advantages across key growth sectors, including AI-DX, Consumer AI, Fintech, Physical AI, Contents IP, and Space. This investment activity was driven by both the expanded capital base following the launch of ZVC Fund II and the growing depth of high-quality investment opportunities across Japan, South Korea, Southeast Asia, and the United States, where a new generation of high-potential startups continues to emerge.

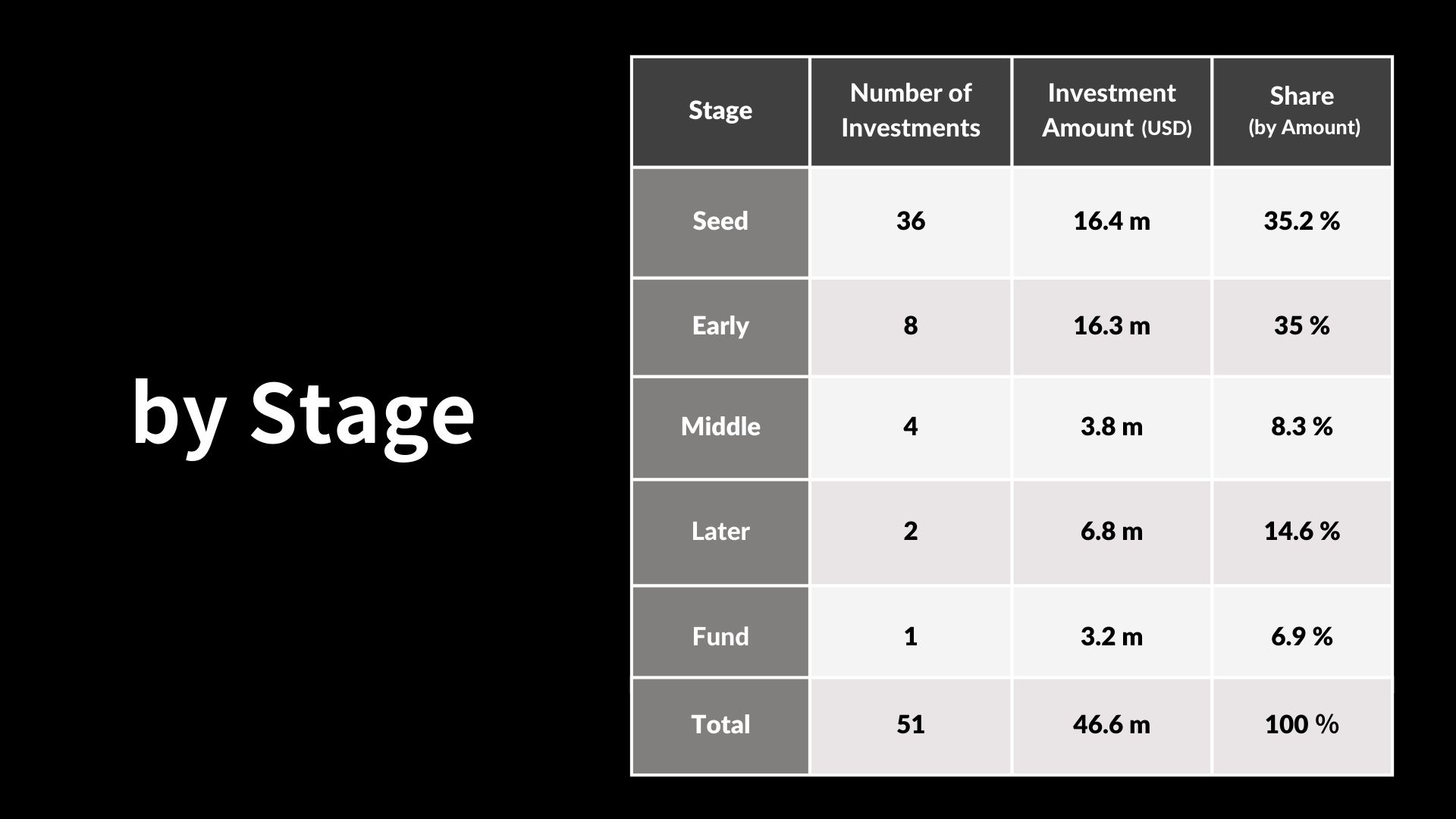

【By Stage】

From a stage perspective, 2025 saw a strong emphasis on Seed-stage investments. Of the 51 investments made during the year, approximately 70% were Seed-stage deals, accounting for 35.2% of the total investment amount. This reflects ZVC’s focus on building early relationships with founding teams positioned to lead future growth industries.

At the same time, ZVC deployed approximately USD 16.3 million into Early-stage companies by investment amount. ZVC also remained active in Middle and Later-stage investments, reinforcing its distinctive all-stage investment strategy, which supports companies consistently from Seed through Later stages.

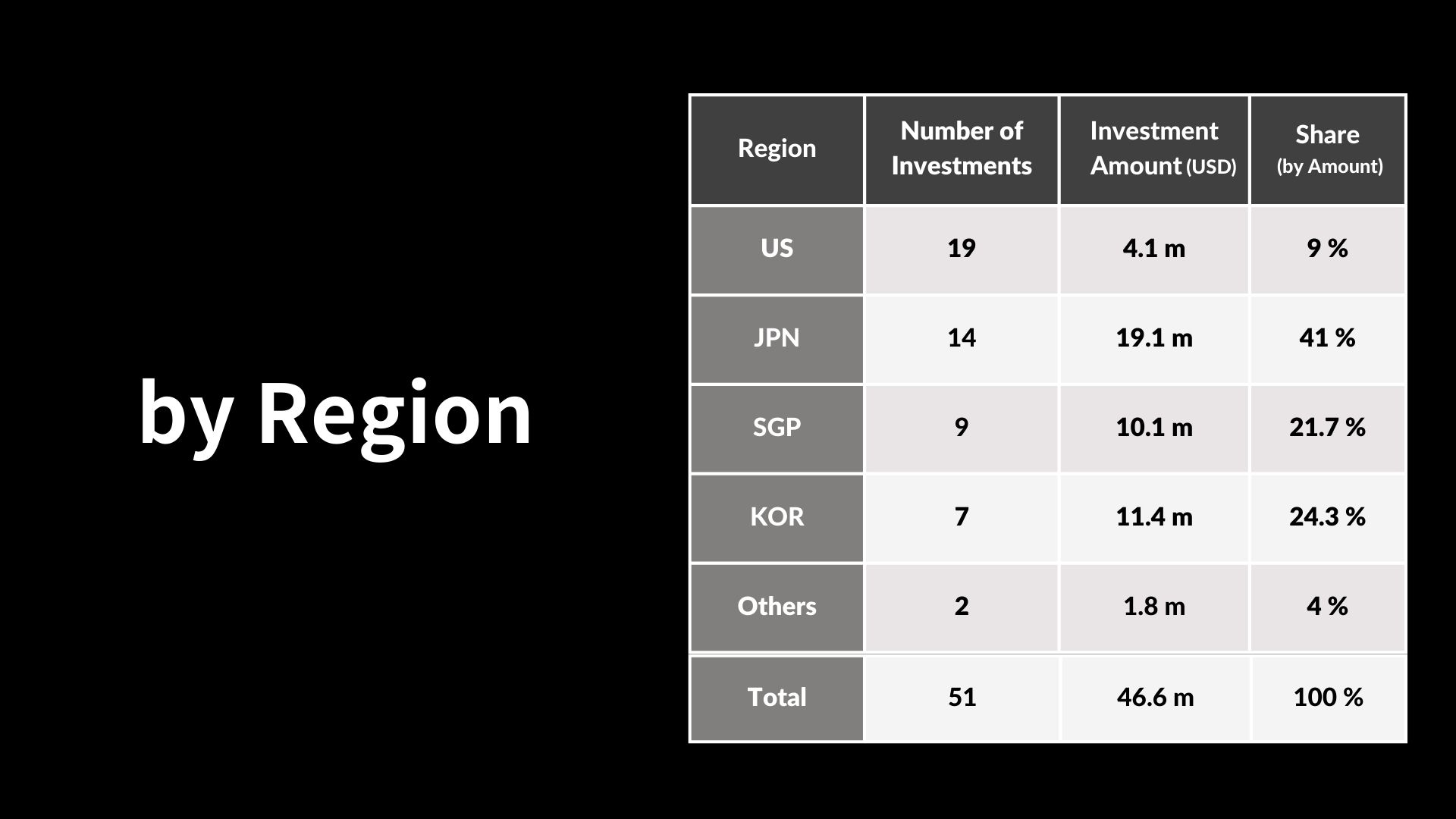

【By Region】

In 2025, ZVC’s global investments were primarily concentrated in Japan, South Korea, Singapore, and the United States, based on companies’ headquarters locations.

Japan accounted for the largest share of investment by value, with approximately USD 19.1 million invested across 14 companies, representing 41% of total investment value. This was followed by South Korea, with approximately USD 11.4 million (24.3%), and Singapore, with approximately USD 10.1 million (21.7%). Meanwhile, ZVC invested in 19 U.S.-based companies, making the United States the largest market by number of investments during the year.

【Key Activities】

Launch of ZVC Fund II (Approximately USD 193.5 million)

In January 2025, ZVC launched ZVC Fund II, a new fund with a total size of approximately USD 193.5 million. Through this fund, ZVC expanded its investment scope beyond LY’s core focus areas of media, commerce, fintech, and AI, and officially began investing in Deep Tech sectors such as Space-tech and robotics.

By maintaining an all-stage investment approach from Seed through Later stages, while deepening support for startups building future industries, ZVC’s investment activities became more active and expansive than ever before.

Opening of U.S. Office in San Francisco (October 2025)

In October 2025, ZVC opened a U.S. office in San Francisco, establishing a strategic hub to connect startup ecosystems across Asia and the United States.

Since 2016, ZVC’s U.S. team has invested in approximately 60 startups. With the opening of this office, ZVC aims to further strengthen its long-term commitment to identifying and supporting cutting-edge technologies that will shape the future.

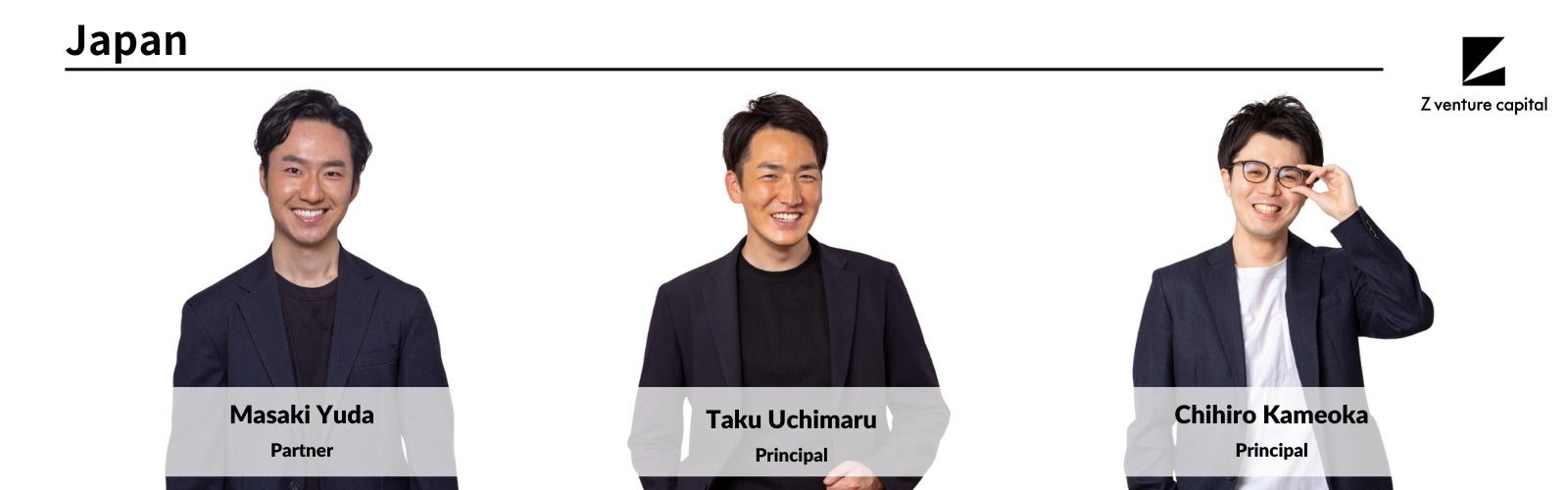

【Regional Reflections/Japan】

In 2025, ZVC’s Japan team invested in 14 companies, deploying approximately USD 19.1 million in total. In addition to established focus areas such as AI-DX, Fintech, entertainment, human resources, B2B commerce, and marketing solutions, the team also actively invested in frontier sectors, including Physical AI and Space, supporting companies creating entirely new industries.

Beyond investments, the Japan team continued to host ecosystem-building initiatives, including “ZVC Connect,”networking events that connect startups with the LY Corporation Group, and “Angel Scramble,” 1-on-1 matching events between startups and angel investors. These events were held across a range of themes and locations and have become platforms where meaningful opportunities emerge.

Notable outcomes include collaborations between portfolio company commmune and ASKUL, Ticketme’s integration as a LINE Mini App, and partnerships between NEIGHBOR and angel investor Kei Tanaka. As ZVC continues to position itself as a global gateway, these initiatives will increasingly expand into cross-border collaboration opportunities.

In 2025, Yuni Kim joined the Japan team as Value Creation Lead. Guided by the vision of “Value Beyond Capital for Founders of the Future,” the team will further strengthen hands-on support for portfolio companies as they scale.

As we close this year and look toward the future, we are grateful for your continued support and collaboration. Let’s achieve even greater success together in 2025.

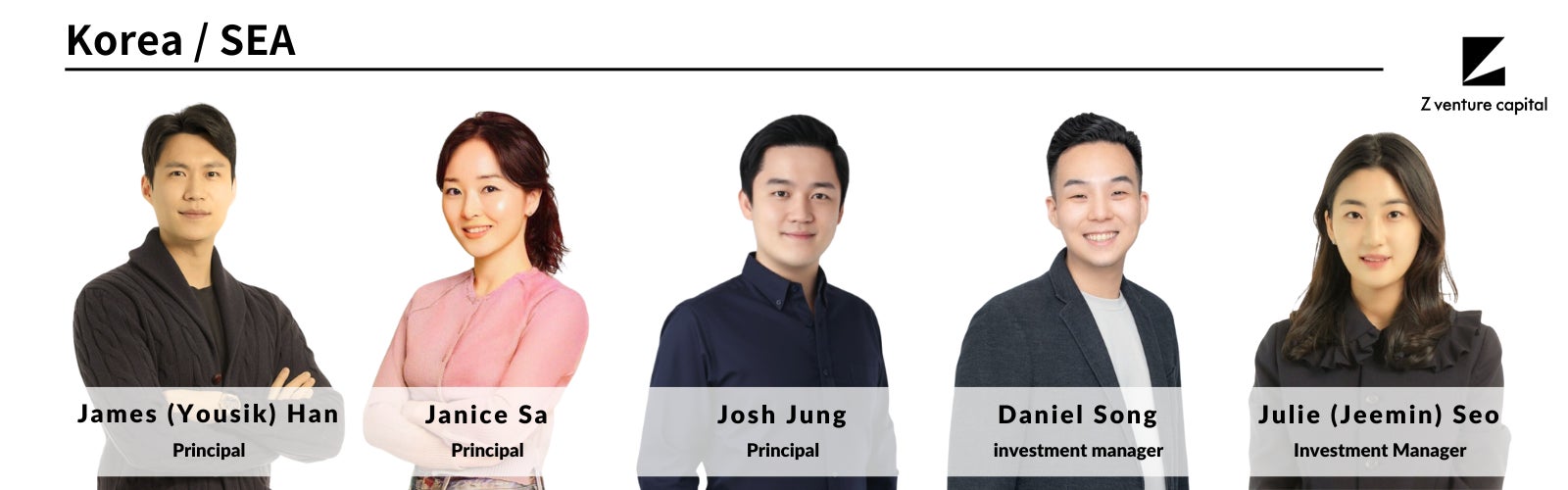

【Regional Reflections/KR・SEA】

As we approach the close of 2025, we find ourselves reflecting not just on milestones, but on the many conversations, ideas, and relationships that shaped this year for the ZVC Korea team. In a period defined by rapid AI adoption and shifting market dynamics, we stayed grounded in what has always mattered most to us: supporting bold thinkers and helping transformative companies take root across borders.

In 2025, the ZVC KR team welcomed 11 new companies into the portfolio and deepened our partnership with 4 companies via follow-on investments. We continued to lean into new media, e-commerce enablement, and fintech, while also embracing the rising wave of AI-native business models reshaping how consumers and enterprises interact with technology. Along the way, we strengthened the internal scaffolding that helps founders scale—with expanded go-to-market support, talent networks, and strategic pathways across the LY Corporation ecosystem.

One of this year’s highlights was welcoming Josh to the team—an engineer by training turned investor with deep experience investing from seed to growth stages across a wide range of sectors. His addition strengthened our technical perspective and broadened our capacity to support founders from the earliest stages of their journey. In Korea, we also deepened our focus on AI-native startups and emerging robotics technologies, building conviction in sectors rapidly advancing on the back of strong manufacturing and supply chain advantages. These efforts have helped us build a more active and informed point of view on the next generation of frontier companies emerging from the region.

Across broader Asia, our team maintained momentum in Southeast Asia—particularly within fintech—while also dedicating more time to Taiwan, where we hosted our first-ever offline event bringing together founders, investors, and partners. This milestone underscores our commitment to building a vibrant, truly cross-border ecosystem. Across Japan, Korea, Taiwan, Southeast Asia, and the U.S., we continue to unlock strategic synergies and strengthen the connective tissue between markets.

As we look ahead to 2026, we feel both humbled and energized. The pace of innovation shows no signs of slowing, and we are inspired daily by the founders who challenge assumptions, reimagine the status quo, and build with conviction. Our role remains simple: to show up early, stay long, and help exceptional teams unlock their full potential.

To the founders imagining what comes next—whether you're building in AI, commerce, fintech, or an entirely new category—we’d love to hear from you. Reach out to the ZVC team and let’s explore how we can build the future together.

【Regional Reflections/USA】

Looking back on 2025, we reflect with gratitude on another year of meaningful progress for the ZVC US team. Amid rapid AI adoption and shifting market dynamics, we remained focused on our core mission: partnering with ambitious founders, supporting our portfolio across every stage of growth, and creating long-term strategic value for LY Corporation.

This year, we were excited to welcome Greg and Kinuko to the team. Their complementary experience across investing, operating, and product development further strengthens our ability to support founders—from product strategy and distribution to organizational design and execution. We also opened our new ZVC office in San Francisco, envisioned as a community hub for founders, operators, and partners. Through this space, we are deepening cross-border collaboration and fostering a vibrant founder community that connects the US with our broader global network.

In 2025, we continued to expand our portfolio thoughtfully, completing 15+ new investments in the US and making five follow-on investments in existing portfolio companies. These investments reflect our conviction that the next generation of category-defining companies will be AI-native from day one—built at the intersection of cutting-edge technology, differentiated user experience, and emerging consumer behavior. Our follow-on investments reinforce our long-term commitment to founders as they scale their products, teams, and go-to-market strategies.

We also deepened our focus on Consumer AI, where a new generation of products is redefining how people create, communicate, learn, and transact. Powered by rapidly advancing AI models and infrastructure, these products unlock intuitive, delightful user experiences grounded in responsible technology.

To support founders building at the earliest stages, we launched Alpha, our pre-seed and seed program designed to back exceptional teams from company formation onward. Through Alpha, we provide capital, hands-on support, and access to our network to help founders build AI-native companies with lasting impact.

Looking ahead to 2026, we remain optimistic about the compounding impact of AI. While debates about hype and cycles continue, we believe we are still in the early innings of this transformation. We are deeply grateful to LY Corporation and to the founders who place their trust in us. Together, we look forward to continuing to push the frontier of AI and build enduring companies.

If you’re building an AI-native company, we’d love to hear from you.

Contact ZVC here

zvc-info@zvc.vc

Share

Share Share

Share Share

Share