ZVC Investment Performance in 2024

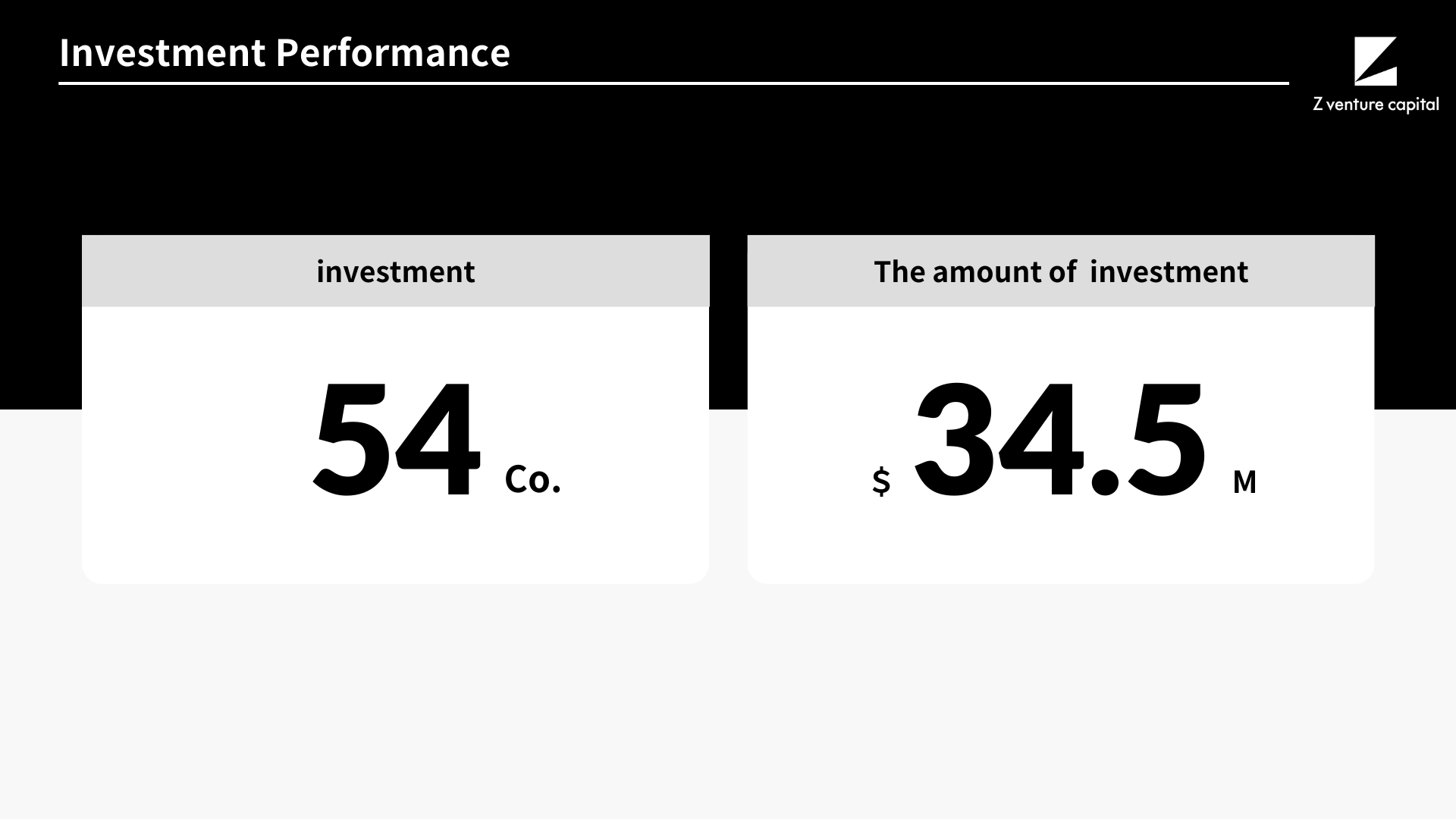

In 2024, Z Venture Capital (ZVC) invested approximately $34.5 million in ¹54 companies across Japan, Korea, Southeast Asia, and the United States.

Our three global offices – Tokyo, Seoul, and San Francisco – were instrumental in identifying and backing these promising startups.

In 2025, ZVC will further accelerate its efforts to connect the LY Group with innovative startups and build a brighter future together.Under the banner of ‘VALUE BEYOND CAPITAL FOR THE FOUNDERS OF THE FUTURE,’ we will continue to create new value as a global CVC.

*(*¹Total number of investments, including follow-ons)

Investment Performance

In 2024, we expanded our investment portfolio to 54 companies, investing a total of $34.5 million.

Our average investment size increased to $638,000 per deal, reflecting our commitment to supporting high-potential startups.

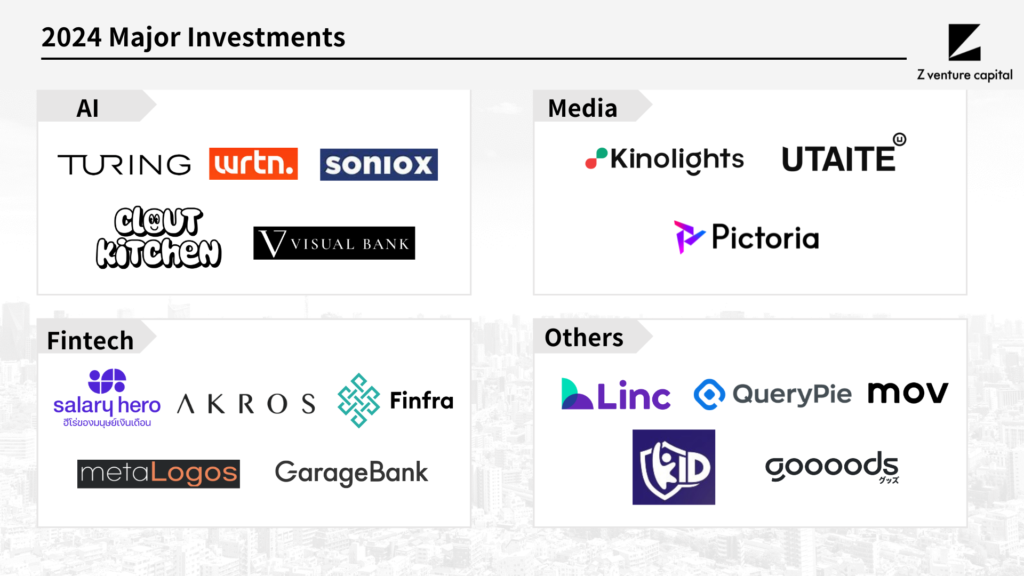

About Our Portfolio

Here’s a glimpse into our 2024 portfolio companies.

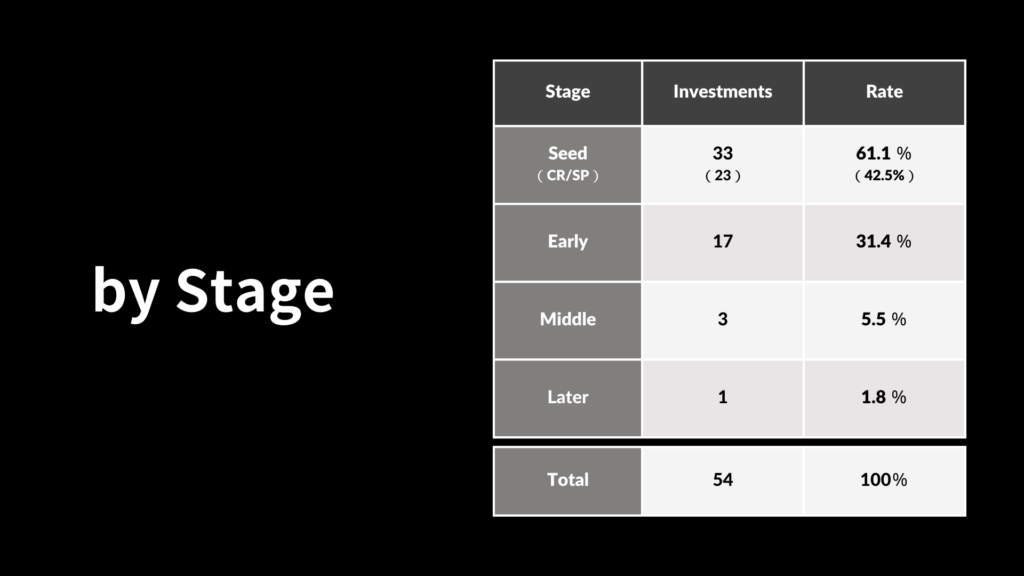

Investment Breakdown

ZVC invests across all stages of a company's lifecycle. In 2024, our early-stage funds, US Seed Program and Code Republic (Japan), played a significant role in our investment strategy, accounting for approximately 40% of our total investments. These funds enable us to make swift and flexible investments in promising startups in the US and Japan.

Moving forward, we will continue to leverage these funds to identify and support the next generation of industry leaders.

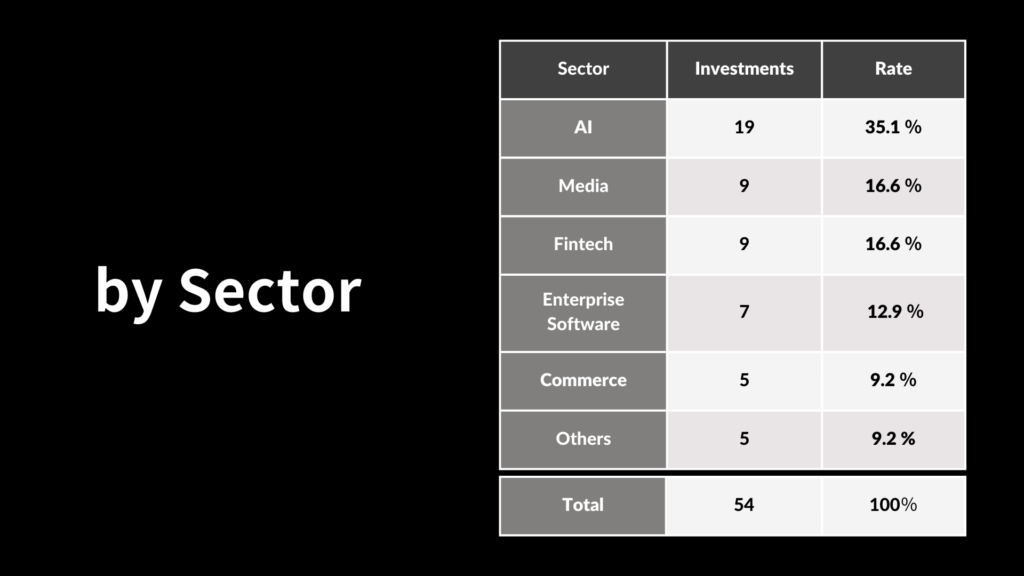

We significantly increased our focus on AI, expanding our investments from 7 companies last year to 19 this year.

While maintaining our focus on Media, Fintech, and Commerce, we also broadened our investment horizon to include Enterprise Software.

We continued to invest in high-growth markets across Asia and the US. The expansion of our US Seed Program led to a 24% year-over-year increase in US investments.

Regional Review

.png)

The Japanese stock market has faced persistent uncertainty due to revisions in monetary policies, a sentiment that continues to influence the startup industry. Nevertheless, signs of growth in the ecosystem are emerging, marked by increased M&A activity and growing interest from international VCs in the Japanese market.

Amid this evolving landscape, ZVC’s Japan team successfully invested in 13 companies this year, focusing on key themes such as Data & AI, Fintech, HR, Entertainment, and B2B/C2C marketplaces. With AI technology advancing at an unprecedented pace, we see this as a pivotal moment for industry disruption. We are continually refining our investment theses, believing that periods of transformation call for bold actions from venture capitalists. In 2025, we plan to push beyond traditional frameworks and embrace new challenges with even greater ambition.

In June, we hosted “ZVC Connect,” an event aimed at fostering collaboration between startups and the LY group. As the integration of our parent companies, LINE and Yahoo Japan, progresses, our internal network has grown stronger. This synergy has enabled us to collaborate with multiple business units on innovative initiatives, and we look forward to delivering even greater value as LY Corporation’s CVC in 2025.

Additionally, Hive Shibuya, a co-working space for seed-stage entrepreneurs that we co-manage with East Ventures and Sun Frontier Real Estate, is about to celebrate its second anniversary. Housing over 40 seed startups, including success stories like TicketMe, which has graduated to its next stage of growth, Hive Shibuya remains a dynamic hub for startup innovation. We remain dedicated to further positioning Shibuya as a vibrant center for entrepreneurship.

This year, we also welcomed two new members to our Japan team: Mei Someya, who has strengthened our middle-back office operations, and Mikiya Sanada, who has joined our front office. Together, we are building a sustainable support structure to advance our mission in the years to come.

As we close this year and look toward the future, we are grateful for your continued support and collaboration. Let’s achieve even greater success together in 2025.

.png)

In 2024, the venture capital landscape in South Korea and Southeast Asia showcased growth, resilience, and innovation. Both regions have continued to mature as dynamic startup ecosystems and despite economic and geopolitical headwinds, the focus on sustainable growth, local adaptation, and sectoral innovation has proven vital. ZVC continued to be active in both regions, closing five new investments in Korea, four new investments in Southeast Asia, and we expanded our position in Taiwan with one new investment.

South Korea stood out with a 25% year-over-year increase in venture capital investments during the first nine months of 2024.

This growth reaffirmed its position as a leader in key industries such as artificial intelligence, robotics, manufacturing equipment and materials, and battery cell technology. The government’s consistent support for innovation, coupled with new policies promoting global expansion for startups, fostered a favorable environment for growth. This robust ecosystem, combined with strong infrastructure and talent, continues to solidify South Korea’s position as a global technology hub.

In Southeast Asia, the venture capital landscape faced a quieter year, with a decline in year-over-year VC investments. Nonetheless, the region’s young demographics and rising consumer spending present fertile ground for long-term growth. The exit environment remains a challenge for investors, however, we see efforts on policy and regulation that will largely alter the course. Despite these hurdles, early-stage funding from Seed to Series A rounds remained vibrant, with fintech, consumer brands, and healthcare emerging as the most active sectors.

Looking ahead to 2025, we see several key areas primed for growth and investment. The integration of AI across industries will remain a dominant theme as businesses increasingly adopt AI-driven tools to enhance operations, personalize experiences, and improve decision-making processes. In South Korea, AI is poised to play a central role in advancing leadership in manufacturing, robotics, smart cities, and healthcare technologies. Meanwhile, in Southeast Asia, localized AI-solutions tailored for Enterprises and SMEs are expected to grow, empowering these businesses to scale efficiently and compete on a global stage.

ZVC remains steadfast in its commitment to identify and support founders driving sustainable growth and innovation. We stand by our mission to provide value beyond capital for our portfolio companies and hope for another amazing year in 2025.

.png)

As we approach the close of 2024, we reflect with gratitude on a remarkable year of significant progress and accomplishments for the ZVC US team. This year, our focus has been on fostering innovation, empowering our portfolio companies, and delivering long-term value to LY Corporation. Despite a dynamic global economic environment, we have remained steadfast in our mission to identify opportunities that shape industries and create meaningful societal impact.

In 2024, we successfully expanded our portfolio by adding 20+ new investments in the US, with a primary focus on early-stage companies in the generative AI space. These investments underscore our belief in the transformative potential of emerging technologies and our commitment to staying at the forefront of innovation. By targeting both application and infrastructure layers within generative AI, we invested in B2B and consumer-facing applications in various sectors including customer support, legal, and healthcare as well as infrastructure layer which is designed to accelerate AI adoption for enterprise and SMB customers and protects online trust and safety.

Several of our portfolio companies achieved outstanding milestones this year, including impressive revenue growth, market expansions, and successful funding rounds. These successes highlight the strength of our strategic approach and the value of the collaborative partnerships we build with our founders and LY Corporation.

As we look ahead to 2025, we are excited to build on this strong foundation and explore new opportunities with founders who share our vision. While some skepticism persists regarding the sustainability of substantial investments in AI, we remain confident in the unprecedented potential of emerging AI technologies and the accompanying demand for new infrastructure to support their adoption. We see immense possibilities in advancing applications that leverage the latest AI advancements alongside the cultural shifts brought by a new generation of users. Most importantly, we are committed to driving innovation that ensures the responsible and beneficial use of these technologies for humanity.

In the coming year, we will continue to support our portfolio companies in scaling their operations, unlocking new markets, and achieving critical growth milestones. Additionally, we plan to explore emerging markets where thriving innovation ecosystems present new opportunities, further positioning ZVC for long-term success.

As we reflect on the achievements of 2024, we are deeply grateful for the continued support of LY Corporation and our founders. As we prepare for an exciting year ahead, we remain committed to building strong relationships and adding strategic value to our portfolios. Together, we will continue to drive impactful innovation and shape the industries of tomorrow.

Share

Share Share

Share Share

Share