Investment Performance in 2023

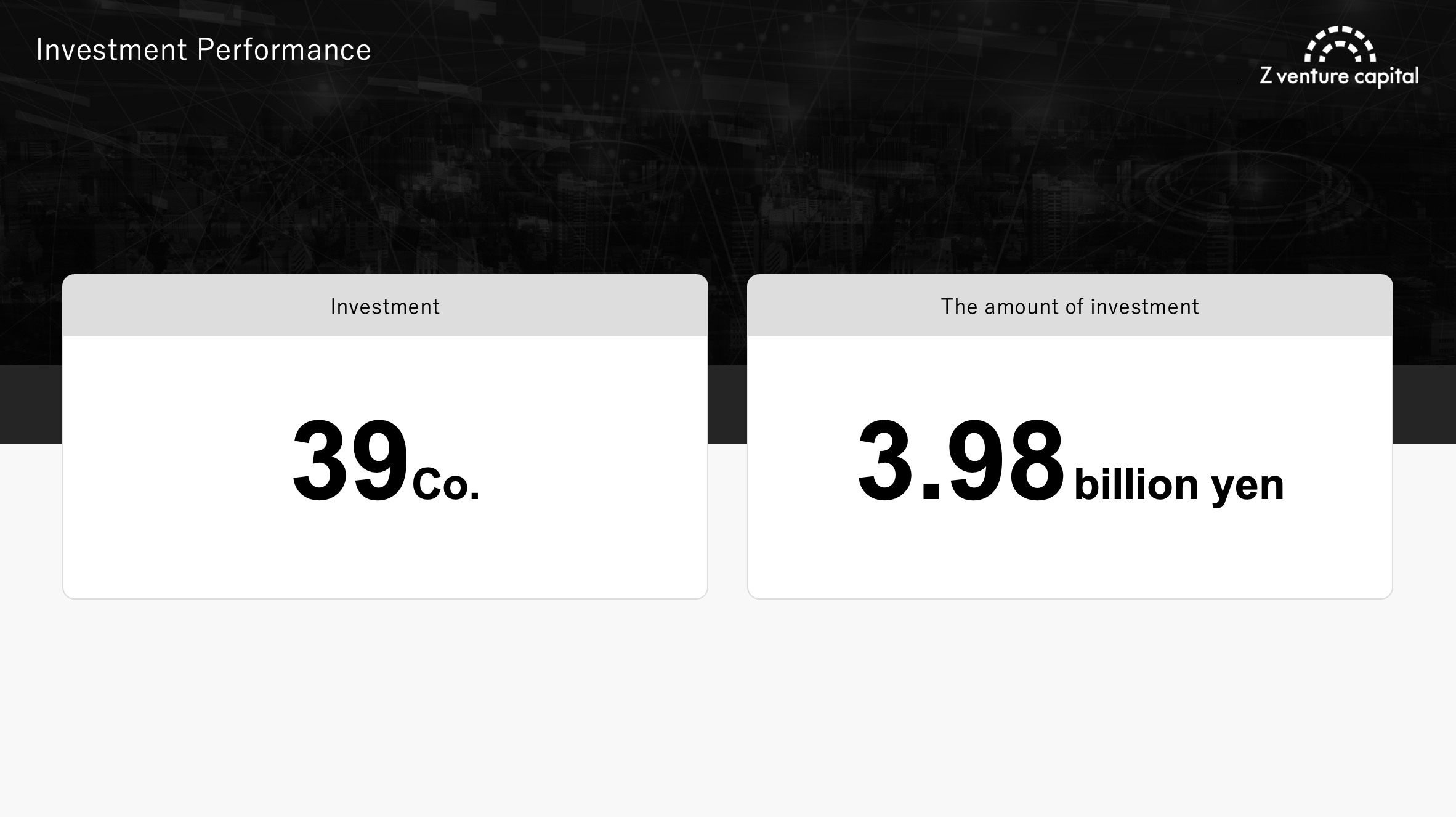

In 2023, Z Venture Capital ("ZVC") deployed 3.98 billion yen in 39 companies across Japan, Korea, Southeast Asia, and the United States.

In 2024, ZVC remains committed to forging synergies across all LY Corporation affiliates and building a collaborative future with its portfolio companies.

Investment Performance

ZVC invested a total of approximately 3.98 billion yen in 39 companies in 2023.(Average per company: Approximately 102 million yen)

ZVC invested a total of approximately 3.98 billion yen in 39 companies in 2023.(Average per company: Approximately 102 million yen)

Investment portfolio

%E4%B8%BB%E3%81%AA%E6%8A%95%E8%B3%87%E5%85%88.jpg) The following is a partial list of ZVC's portfolio investments in 2023. Generative AI has become a major trend in 2023, and ZVC is actively investing in generative AI in addition to its focus areas of media, commerce, and fintech.

The following is a partial list of ZVC's portfolio investments in 2023. Generative AI has become a major trend in 2023, and ZVC is actively investing in generative AI in addition to its focus areas of media, commerce, and fintech.

Investment Details

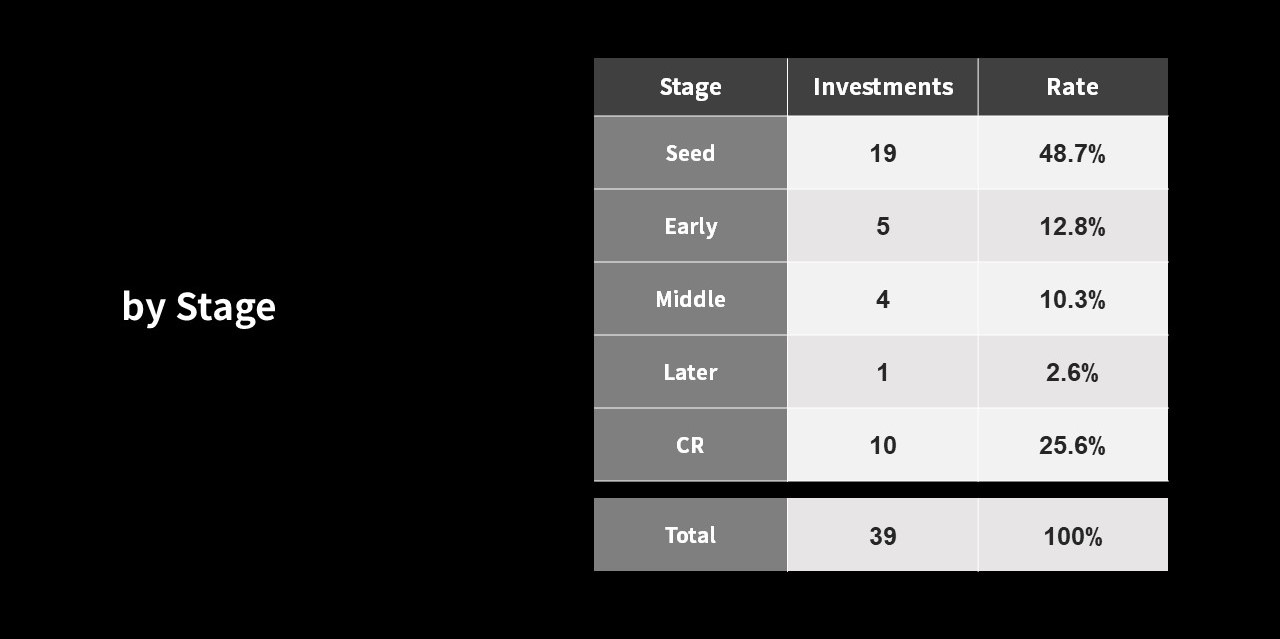

ZVC continued its all-stage investment strategy throughout the year and further solidified its commitment to early stage startups via the inaugural Seed Investment Program in the US. ZVC also invested aggressively through its revamped Seed Investment Program (CR).

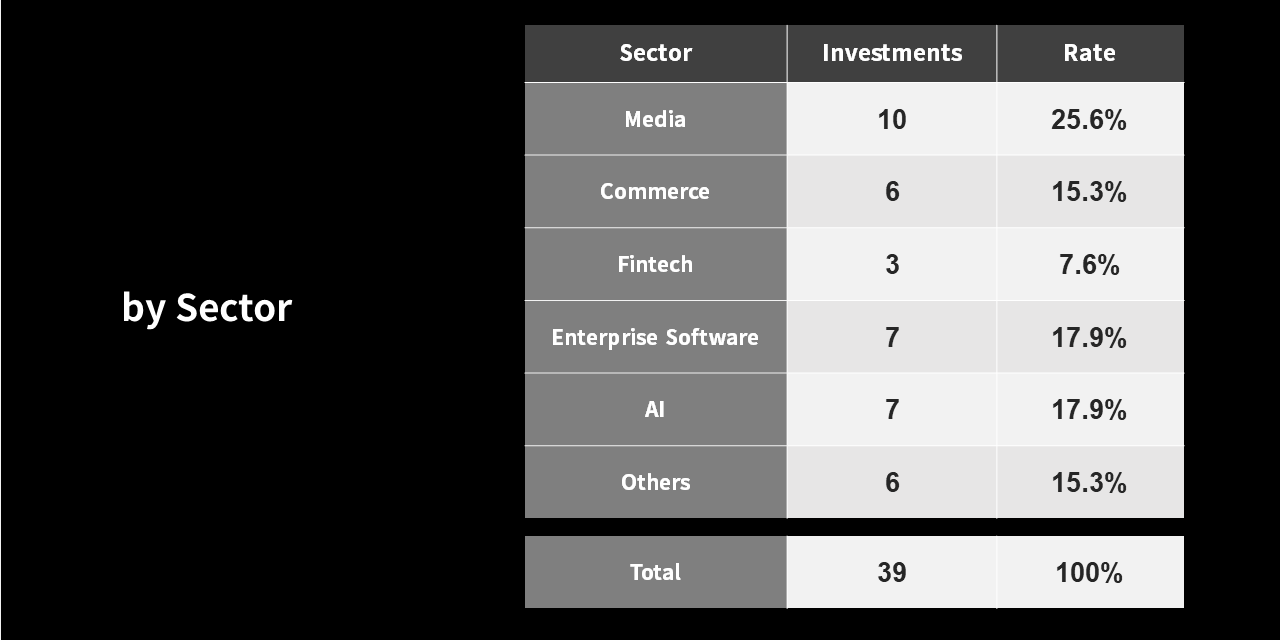

ZVC continued its all-stage investment strategy throughout the year and further solidified its commitment to early stage startups via the inaugural Seed Investment Program in the US. ZVC also invested aggressively through its revamped Seed Investment Program (CR). While maintaining a strong focus on our core sectors including media, e-commerce, and fintech, we actively expanded our investment horizon in sectors like enterprise software and generative AI.

While maintaining a strong focus on our core sectors including media, e-commerce, and fintech, we actively expanded our investment horizon in sectors like enterprise software and generative AI.  Geographically, we concentrated our efforts in Japan, Korea, Southeast Asia, and the US, leveraging our established regional presence and corporate assets. Looking ahead to 2024, we remain committed to backing founders in these key markets.

Geographically, we concentrated our efforts in Japan, Korea, Southeast Asia, and the US, leveraging our established regional presence and corporate assets. Looking ahead to 2024, we remain committed to backing founders in these key markets.

CEO's Comments

2023 was a tough start for the startup industry. The first half of the year saw the impact of a sluggish stock market, with many stories of companies delaying their fundraising timing or pushing back their planned IPOs for this year. There were also whispers that Web3 had entered a winter phase. Looking back at ZVC's investment activities, we made 39 investments totaling 3.9 billion yen. This was a decrease of 30% compared to the previous year in terms of amount.

Looking at the trends in our investments, the rise of ChatGPT has led to an increase in investments in the AI field. In addition, investments in startups in the entertainment and healthcare fields, which have been affected by lifestyle changes due to the corona disaster, have progressed. In 2024 as well, the social implementation of AI will continue to advance. I am looking forward to seeing what kind of interesting services will appear at the application layer.

In October, the parent company of Z Venture Capital (ZVC) changed from Z Holdings to LY Corporation. The management structure of the parent company has also changed, and the strategy of the business units will be updated. As ZVC, we would like to further strengthen our network with group companies and make good use of it in our investment activities.

On a personal note, I will be leaving my position as CEO at the end of December 2023. Thank you for your continued support. Please continue to support the new ZVC starting in 2024.

Japan Team

In 2023, I continued to focus on fintech and SaaS companies and made several investments.

Reflecting on Japan's Fintech and SaaS markets, the widespread adoption of a cashless culture among consumers, led by PayPay, has become deeply ingrained. Additionally, the shift toward cashless solutions in the B2B space, including corporate cards, and the growing prevalence of SaaS supporting corporate functions, have accelerated significantly. In terms of emerging technologies, the introduction of Generative AI, and the recent apparent recovery of Bitcoin and the DeFi market are particularly noteworthy. Notably, AI technologies like Google's "Gemini" and Open AI's "Q*" are poised for rapid evolution, representing an ongoing megatrend that is reshaping our world.

From this perspective, in 2024, I would like to invest in startups that replace the value proposition of existing corporate services with AI-based solutions, companies with strengths in proprietary datasets and embedded technologies crucial for the widespread implementation of AI, and promising areas within the DeFi sector expected to thrive due to legal reforms and technological advancements such as AI. As the investment arm of LY Corporation, we will continue to support startups that leverage technology to update our lives.

The tumultuous year of 2023 is almost over.

I have seen a number of major trends in the area of commerce that I am responsible for. 2023 was the year of generative AI, with daily announcements of generative AI-related services from large companies like Amazon to individuals, creating a world where anyone can easily start an e-commerce business. It was also a year of convergence between media and commerce, with major social networks like YouTube and TikTok, and fandom companies like Spotify and Fanatics focusing on commerce.

This year also saw a major breakthrough for commerce services originating from China. Temu, a huge hit in the U.S. due to its remarkably low prices and influencer marketing, launched in the country in July and reportedly became the fastest shopping app in history to surpass 4 million downloads.

In terms of investment activity in 2024, we will continue to focus on trends in generative AI and areas where media and commerce converge. In particular, we will pay attention to startups that aim to empower individuals and creators. Commerce is not limited to the transaction of goods, but can take many forms, including services and digital content. We are open to investing in platforms that aim to solve societal issues such as labor shortages, declining birthrates, aging populations, and GX.

While 2023 may have been a challenging year for startups, 2024 will be a year for me personally to further accelerate my investments. We will strive to support as many of you as possible. We look forward to working with you in the coming year!

2023 was a year in which we were able to invest in the coming future of media and entertainment, including the metaverse, 2.5D IP, and NFT.

In 2024, as in 2023, we are paying close attention to the area of GenerativeAI×Media & Entertainment. We believe that GenerativeAI will significantly lower the bar for creating media and entertainment content.

Video, which used to be produced by professionals, has shifted to user-generated content (UGC) platforms like YouTube and TikTok. In gaming, platforms like Roblox and Fortnite, where users create maps and games within the game, have recently attracted attention, with Roblox having a DAU of 70.2 million. If content can be easily created with GenerativeAI, this trend should accelerate even in areas where user contributions have been difficult.

Therefore, we plan to actively invest in companies that provide content creation tools using GenerativeAI, companies that efficiently produce content using AI technology, and UGC submission platforms.

We hope to make 2024 another year of aggressive investment in the future of media and entertainment, even more so than 2023.

KR Team

We believe that the year of dragon (2024) will likely follow the suit of the year of rabbit with high uncertainties ahead.

Nonetheless, team ZVC KR would like to roll-out our investment thesis as below with the mindset of venture assistance model on the back of LY Corporation (formerly Z Holdings) ecosystem to help the startup ecosystem.

ZVC KR’s key focus area & themes would be below:

-Fin-tech / Retail-tech / Media / Enterprise Solutions / AI / Make in Korea

We do believe that AI technology (recently started to perform deductions) is now commercially available. However, we do not think AI is an objective but rather a tool. Therefore, we would like to find jewels that are disrupting the status quo of existing industries powered by AI.

Despite Korea merely taking 2% of the global GDP, we strongly believe that Korea can act as a hub and incubating center for global startups. Hence, we will keep supporting Korea based startups’ global development.

On top of LY Corp’s main business areas - including EC, Fin-tech and Media - we would like to focus on Enterprise Solutions (B2B) not only due to the relatively higher profitability but also smoother in terms of seeking for global market fit.

In terms of stage-wise, we would like to remain focused on Series-A (and earlier), build-up strong relationships and become long-time partners with startups helping them in various ways as a venture assistant.

SEA Team

2023 was a year of introspection and recalibration for venture capital in Southeast Asia with deal value dropping more than 50% YoY.

Looking ahead to 2024, we expect continued recalibration in the 1H of 2024 followed by a moderate rebound in venture capital activity as inflation and interest rates gradually ease. Our stage strategy in the region will remain attuned to early stage companies that are able to show balanced growth and profitability. Not particularly one focus over the other.

Our sector strategy remains agnostic however, we have strong conviction in several verticals including embedded finance, online travel, digital health, and education. In addition, the booming e-commerce landscape outside of traditional marketplaces presents a compelling opportunity for us to invest in the next-gen of startups disrupting the e-commerce tech stack. Beyond individual sectors, we believe macro-level shifts in sustainability, grassroots digitalization, and rising consumer spending will reinforce the rebound in venture capital investments in the region.

While Singapore and Indonesia remain key markets for us in Southeast Asia, we are gearing up our activity in high-growth hubs like Thailand and Vietnam, where we hold a strong base of strategic assets and network.

In 2024, the 'tech winter' is unlikely to fade away immediately. This period, however, presents a unique opportunity for investors, as it's when only the most resilient and determined founders are willing to embark on their startup journeys. Our goal is to identify and support these entrepreneurs right from their earliest ventures, including the seed stages.

The South Asia region boasts the world's fastest-growing working-age population and a rapidly increasing GDP per capita, leading to solid consumer spending patterns. This trend will continue to unveil significant potential for technology to enhance everyday life. My primary focus will be on empowering customers' purchasing power with particular emphasis on keywords such as #discovery-based-shopping, #livestreaming, #microinfluencers, #healthcare, and #consumerlending.

US Team

In 2023, Venture capital, especially in Crypto/Web3, faced challenges with a downturn due to unstable macro environment and increased regulatory scrutiny in Web3. Despite these challenges, the emergence of groundbreaking AI technologies, such as OpenAI's ChatGPT, marked a transformative moment with new opportunities.

Adapting to the volatile economic landscape, ZVC US prioritized managing existing portfolios and shaping future strategies in 2023. Our focus included identifying potential winners and sectors in the generative AI, leading to the establishment of US Seed Program for early stage startups.

Looking ahead to 2024, amidst a US presidential election and continued global uncertainties, we anticipates the substantial expansion of generative AI in real life and rebound of Web3 projects. With growing adoption of AI in enterprises, we foresee increased competition among startups and incumbents akin to the early days of internet and mobile revolution.

In 2024, our strategic focus centers on exploring opportunities in 1) new business models and consumer applications utilizing new AI, 2) AI infrastructure emphasizing safety, security and privacy to accelerate the adoption, and 3) domain-specific AI applications, including climate change, healthcare, finTech, etc.

Our commitment is to nurture innovation and support ventures shaping the future of AI.

The US is a massive market, serving as a key area where numerous startups take on challenges with new technologies and business models. One of the primary activities of the US team is to understand the latest technological trends and business dynamics in the industry related to LY Corporation, with the goal of identifying investment opportunities. More specifically, we focus on early-stage startup investments.

In 2024, it is anticipated that development of AI foundation models will accelerate further, and various applications and services will be continuously released. We aim to prioritize the review of the services that provide entirely new user experience by utilizing AI. Particularly, I am interested in the impact of AI on the media and content industries where AI can improve productivity and creativity significantly.